Islamic Development Bank leverages blockchain in Shari'ah law compliance.

01.

Islamic Development Bank supports financial inclusion in member countries

Impact Overview

- Control of spend by subsidy type at any time.

- Subsidy distribution efficiency moving from analog to digital.

- Fully transparent subsidy distribution.

Challenges

Adhering to Shari'ah Islamic law

The Islamic Development Bank is a multilateral development finance institution specialising in Islamic finance. IsDB must consider how to create an efficient and transparent system for Shari'ah-compliant subsidy distribution for its 57 member countries globally, encompassing 1.7 billion people.

Supporting multi-culturalism

How blockchain technologies can be used to support financial inclusion and development.

Solutions

- A shari'ah-compliant blockchain-based subsidy distribution system, for the tokenization of fiat currency, and the distribution of subsidies in a peer-to-peer manner to the people.

- The entire contractual process for Islamic institutions was automated, alleviating the additional administrative and legal complexities and redundancies associated with Sharia-compliant financial products.

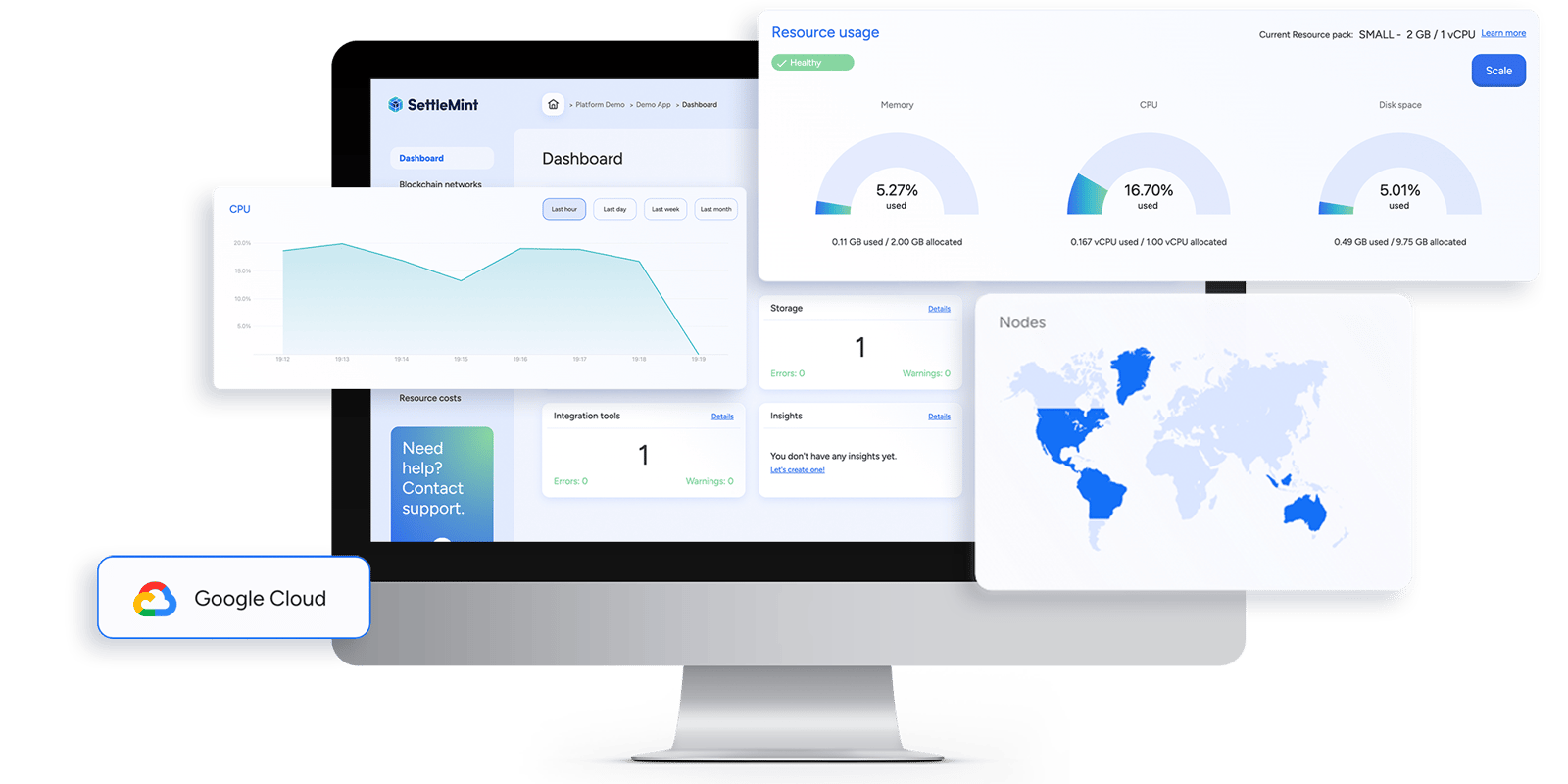

- IsDB used the SettleMint Platform for the tokenization of fiat currency and to distribute the subsidies in a peer-to-peer manner to the people. Using blockchain for subsidy distribution allows for full control of spend by subsidy purpose at any time, ensuring IsDB that the aid is being spent as intended.

The entire contractual process for Islamic institutions was automated, alleviating the additional administrative and legal complexities and redundancies associated with Sharia-compliant financial products. SettleMint partnered with Ateon, a Riyadh-based solution provider and systems integrator in the Fintech space.

One of the core values of SettleMint has always been to change the world for the better, and by using the blockchain technology to further financial inclusion and development of the 57 member countries, fits our ambitions to the letter.

02.

IsDBI develops market stabilization system to remove excess irrational market volatility

Impact Overview

- Fully automated system to achieve market stabilization removing possibilities for human error in market interventions.

- 30-50% reduction in market volatility for assets used as collateral for sharia compliant lending products.

Challenges

Adhering to Shari'ah Islamic law

Assets such as commodities are often used as collateral in shari'ah-compliant lending; however, these assets are frequently subjected to excessive market volatility, which undermines the core principles of shari'ah-compliant finance.

Navigating Existing Infrastructure

Market stabilization mechanisms have been around for many years, but typically require extensive reserves that can be activated in times of volatility to stabilize markets. The challenge lies in making assets and the collateral they represent less volatile.

Solutions

- To anticipate asset price volatility swings, advanced market modeling is required.

- Development of advanced algorithms based on order book activity and price volatility.

- Prediction model utilizing monte-carlo simulations of market and price behaviour.

- A system of smart contracts that automatically regulates market volatility, generating tokens representing either buy or sell orders injected into the market when volatile market conditions arise.

Discover the technology behind the stories

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.