Deploy in minutes, customize easily

Build your digital assets platform with the SettleMint Asset Tokenization Kit. Get the dApp UI and Smart Contracts out of the box—fully customizable source code is available.

Introducing

The SettleMint Asset Tokenization Kit

The SettleMint Asset Tokenization Kit is a full-stack solution designed to accelerate the development of digital asset platforms. With built-in tools for smart contract deployment, asset tracking, and seamless blockchain interactions, the kit simplifies the creation of secure and scalable tokenization solutions.

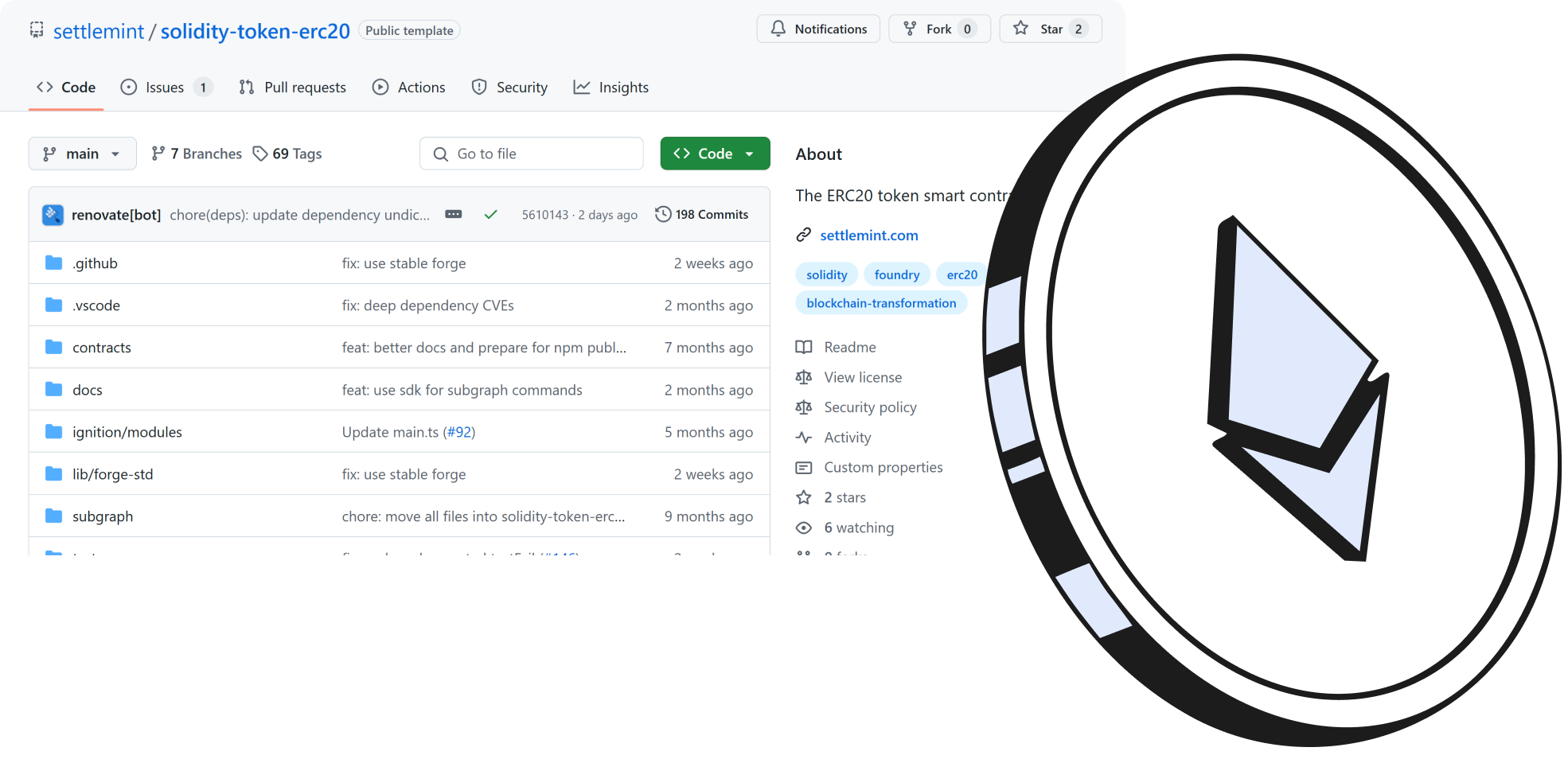

Ready-to-use smart contract templates

Our pre-built smart contract templates make it easy to issue, manage, and transfer tokenized assets such as stablecoins, bonds, securities, and real-world assets (RWAs).

Pre-built dApp

The kit’s low-code approach and ready-to-use dApp web UI streamline the deployment process, reducing time-to-market and ensuring compliance with regulatory frameworks.

XvP Atomic Settlements

The X versus Payment (XvP) Settlement is a solution enables atomic, trustless settlements of digital assets between parties. This feature provides a mechanism for executing delivery-versus-payment (DvP), payment-versus-payment (PvP), or any asset-versus-asset exchange in a single, indivisible transaction.

Easy Management

The SettleMint Asset Tokenization Kit includes detailed dashboards and advanced analytics, providing real-time insights into tokenized assets, transactions, and user activity. Financial institutions and enterprises can track token issuance, transfers, holdings, and on-chain interactions through an intuitive interface.

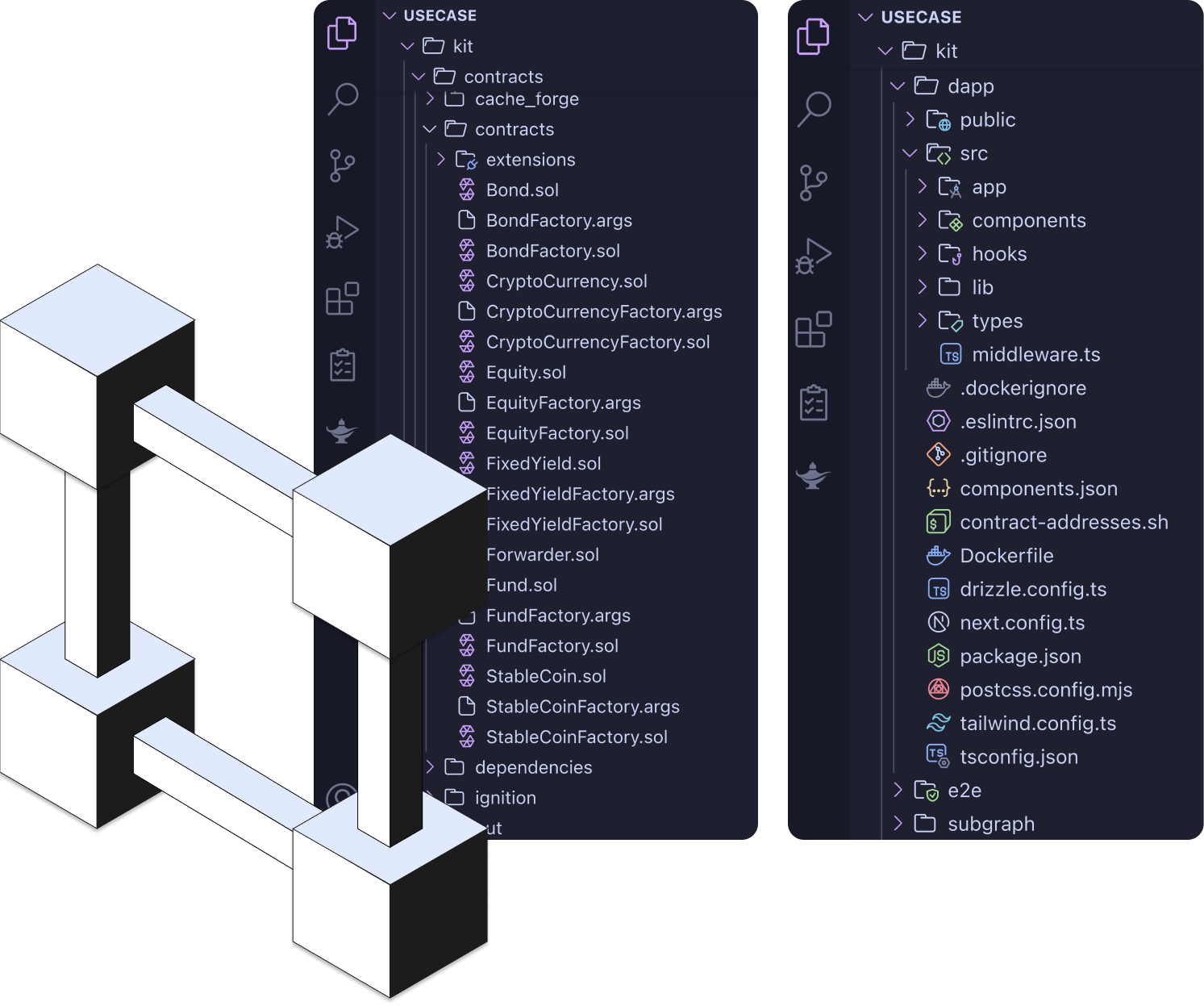

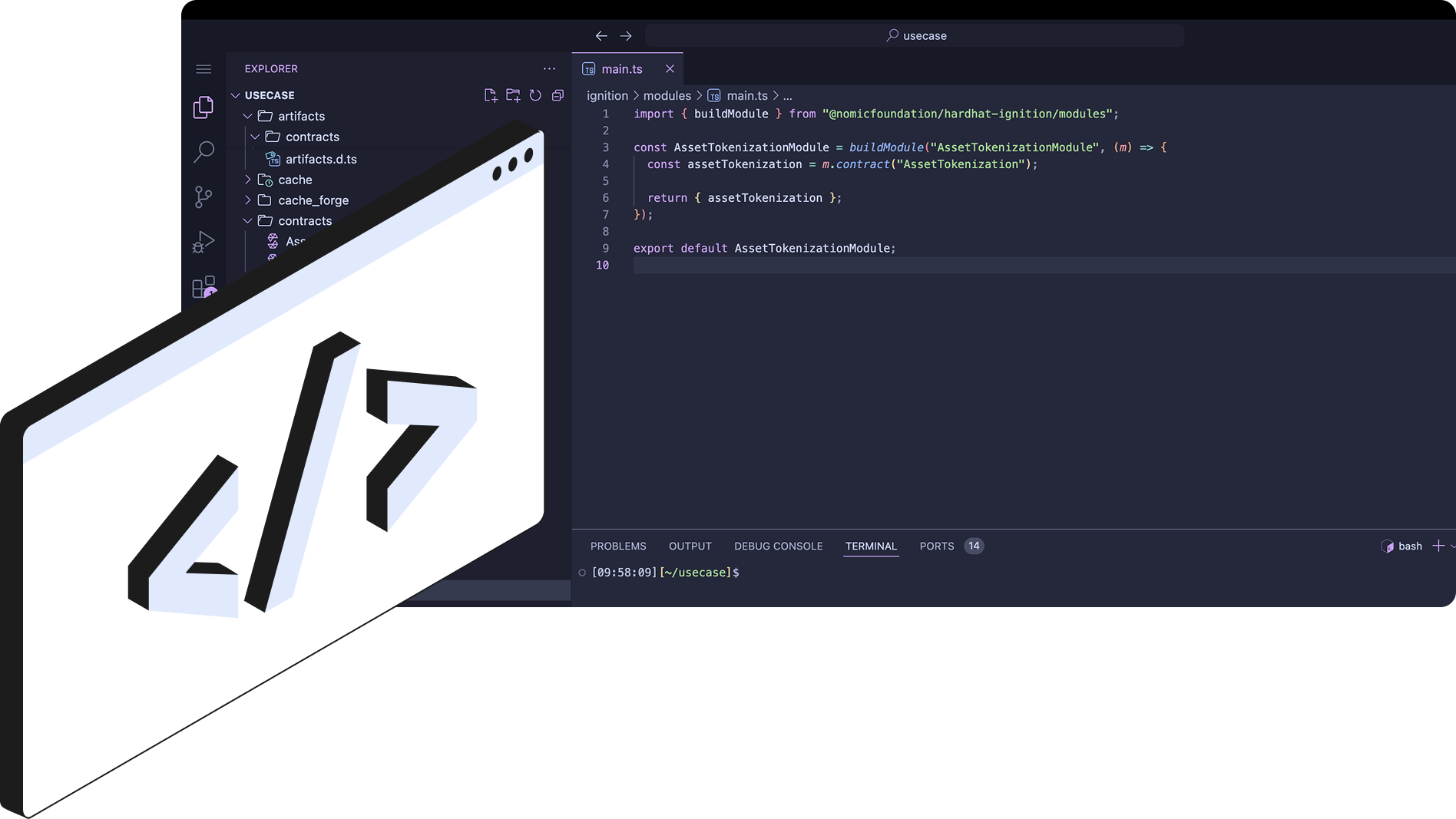

Fully Customizable Code

Our opensource dApp templates enable further customizations of the application for your branding, look and feel. You can add more features and integrations and still deploy in minutes.

From Concept to Launch in Days

Create and configure digital assets using pre-built templates

Launch with confidence using tested, security-focused components

Customize and extend every aspect to match your specific needs

*Our clients report 4x faster smart contract development and 8x faster front-end creation compared to building from scratch.

Six Token Classes for Every Need

Choose from our range of ready-to-use token templates. Each class comes with built-in compliance controls and configurable parameters.

Real Estate

Bonds

Debt instruments with programmable yield schedules

Equities

Digital shares with automated cap table management

Funds

Stablecoins

Deposits

Ready to Accelerate?

Book a call with one of our experts to achieve the benefits of asset tokenization today

Security & Compliance at the Core

We built the Asset Tokenization Kit with enterprise requirements in mind:

- Whitelisted address restrictions

- Configurable transaction limits

- Comprehensive audit logging

- Role-based access control

- Integrated KYC/AML workflows

These features help align with regulatory expectations and support both internal governance and external obligations.

Who Benefits from the Asset Tokenization Kit

Banks & Financial Institutions

Fintech Startups

Build platforms for fractional ownership

Corporations

Issue loyalty tokens and digitize internal assets

Government & Regulators

Run sandbox projects for CBDCs or digital bonds

We're Here to Simplify the Process

Whether you're a developer looking to know more about the underpinings of launching your own platform or an executive wondering how applicable this is to your business, there's something in here for everyone.

See How It's Done

Watch our CTO, Roderik van der Veer, as he demos the ins and outs of the kit.