Digital Asset Lifecycle Platform

Compliant. Scalable. Secure.

The Infrastructure for

Tokenized Digital Assets

DALP is SettleMint's production-grade infrastructure to design, launch, and operate tokenized financial instruments and real-world assets without building blockchain systems from scratch.

Built for regulated institutions moving from pilot to production

DALP serves financial institutions that need to operate tokenized assets at enterprise scale — with the compliance, custody, and lifecycle automation that production demands.

Accelerated time-to-market

Reduced operational risk

Regulatory confidence

Scalable business models

Strategic flexibility

One platform

Full Lifecycle Coverage

Most tokenization solutions stop at issuance.

DALP covers issuance through servicing — the complete operational lifecycle that regulated institutions require to run tokenized assets in production.

Multi-class issuance

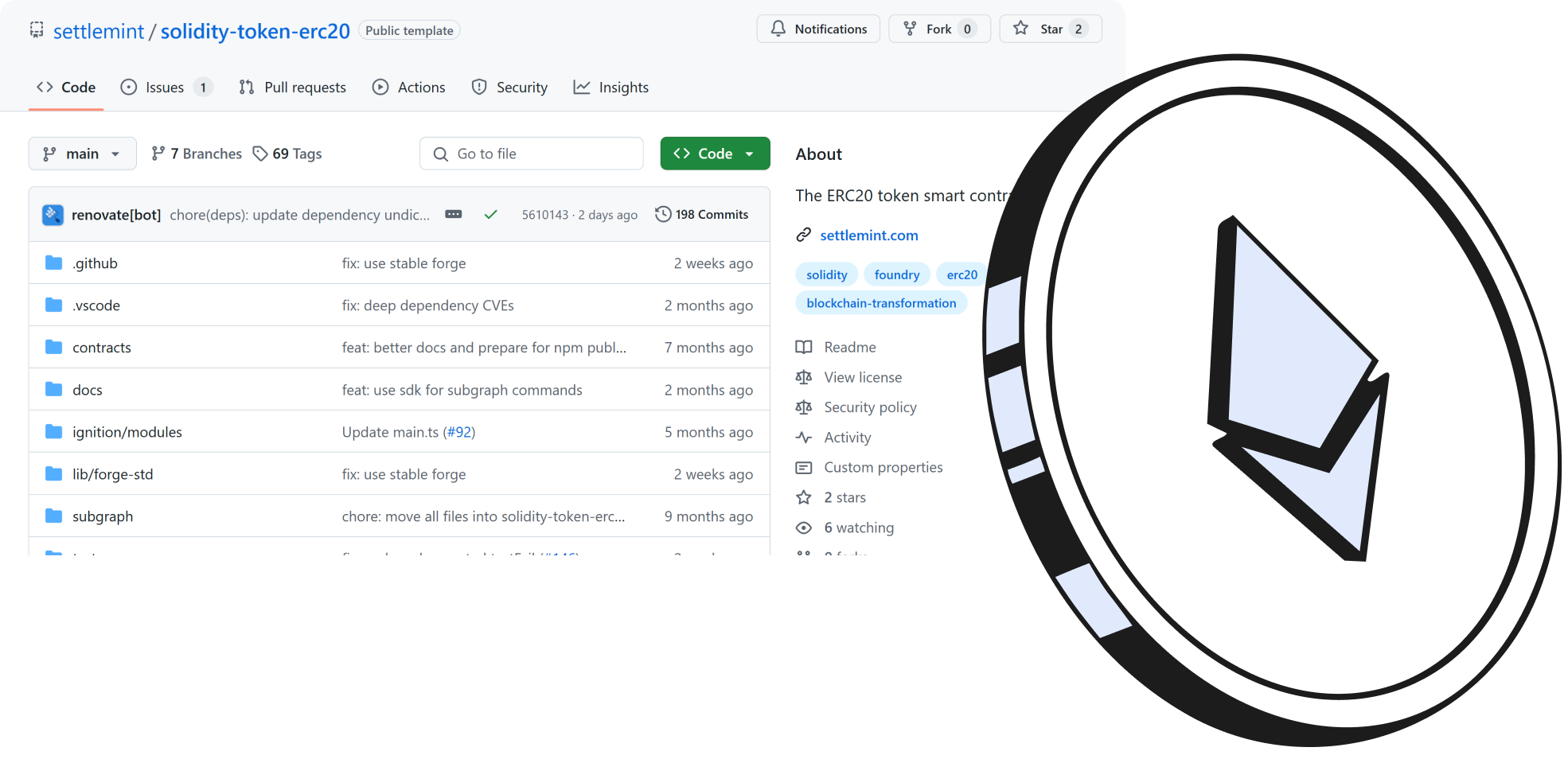

7 Asset Classes + Configurable Token

Deploy tokenized assets across 7 classes using purpose-built templates with configurable business rules and compliance controls.

Or, tokenize any asset using a composable, feature-rich token architecture with dynamic runtime capabilities, full ERC-3643 compliance, and the same governance and custody controls as every other DALP asset.

DvP & XvP

Atomic Settlements

Atomic DvP (Delivery versus Payment) and XvP (Exchange versus Payment) settlement.

Both legs of every transaction complete together or revert together.

No partial execution, no counterparty risk, no reconciliation.

Compliance at the core

Multi-Jurisdiction Support

Every transaction is validated before execution, not flagged after the fact.

18 configurable compliance module types enforce transfer restrictions, investor eligibility, holding periods, and jurisdiction-specific rules.

Multi-jurisdiction support covers EU MiCA, Singapore MAS, UK FCA, Japan FSA, and additional frameworks.

Built on the ERC-3643/T-REX standard with OnchainID identity protocol.

Custody integration

Bring Your Own Custodian

Enterprise key management through Key Guardian: maker-checker workflows, RBAC with defined roles, HSM integration, and recovery procedures.

Bring Your Own Custodian — connect custody providers through the same interface.

Servicing and management

Operate at Scale

Automated lifecycle operations that run after issuance: coupon payments, yield distribution, dividends, redemptions, and maturity handling.

Real-time cap tables, investor reporting, and corporate action processing.

DALP vs Alternatives

DALP provides production-proven infrastructure with 7+ years at regulated banks — delivering faster time-to-value with lower risk.

Internal builds require specialized blockchain and financial infrastructure expertise, typically take 12–18 months to reach production, and create ongoing maintenance burden.

DALP adds the regulated financial services layer: ex-ante compliance, atomic settlement, enterprise custody, and automated lifecycle operations.

Base-layer blockchains provide infrastructure — not compliance, custody integration, asset-specific lifecycle logic, or servicing automation.

DALP covers issuance through servicing — across 7 asset types and configurable tokens, multiple jurisdictions, and multiple chains from a single platform.

Point solutions typically cover issuance but lack lifecycle management, settlement capabilities, multi-asset support, or servicing automation.

6 Out-Of-The-Box

Digital Assets Classes

Choose from our range of ready-to-use token templates. Each class comes with built-in compliance controls and configurable parameters.

Real Estate

Bonds

Debt instruments with programmable yield schedules

Equities

Digital shares with automated cap table management

Funds

Stablecoins

Deposits

Who is DALP for?

Regulated institutions moving from pilot to production, at scale.

Banks and financial institutions

Retail, private, and investment banks launching tokenized bonds, deposits, funds, and structured products. From first issuance to multi-asset, multi-jurisdiction operations.

Asset managers

Custodian and market infrastructure

Sovereign entities

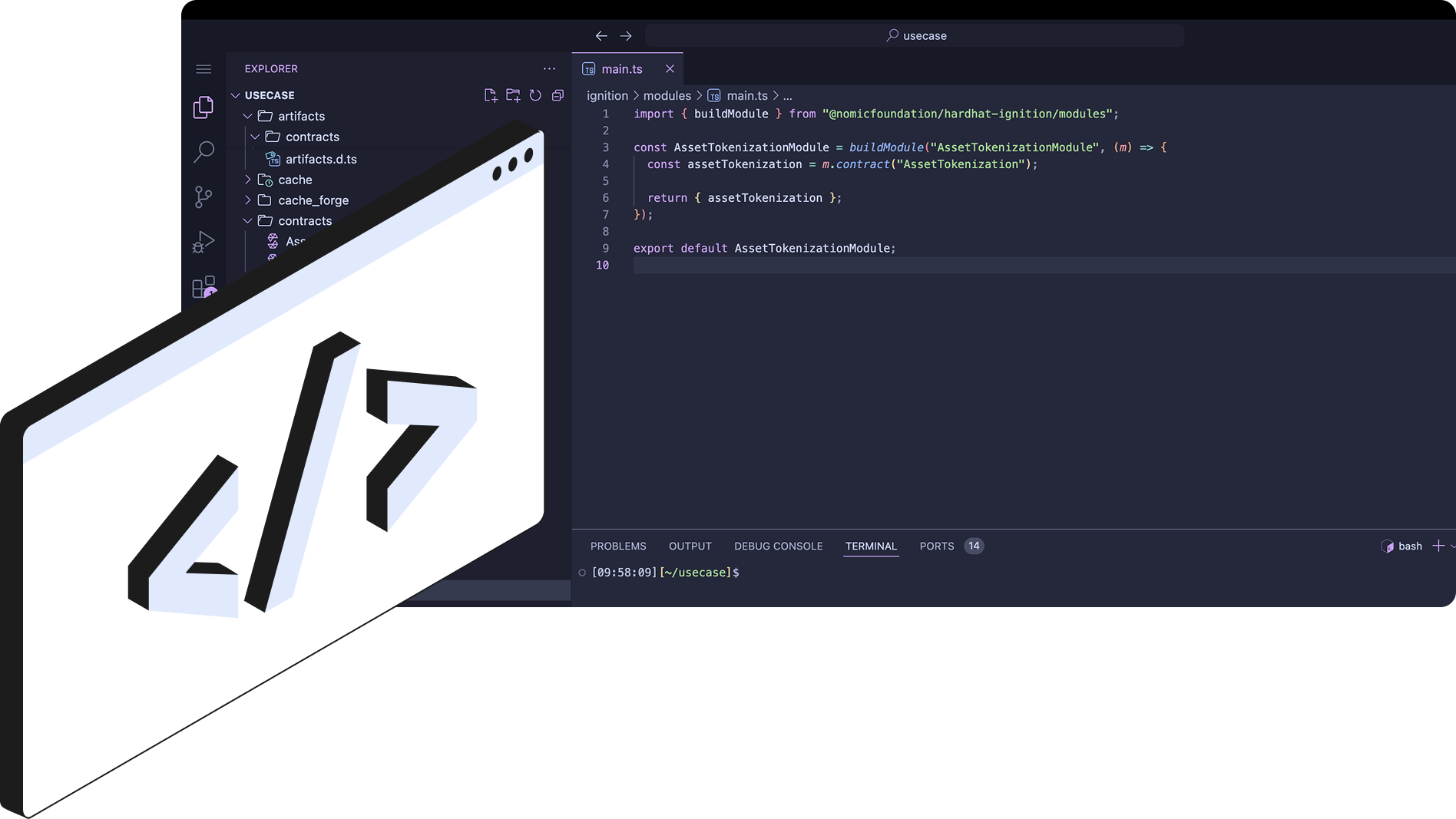

How DALP Works

From design to production in five easy steps.

① Design your asset

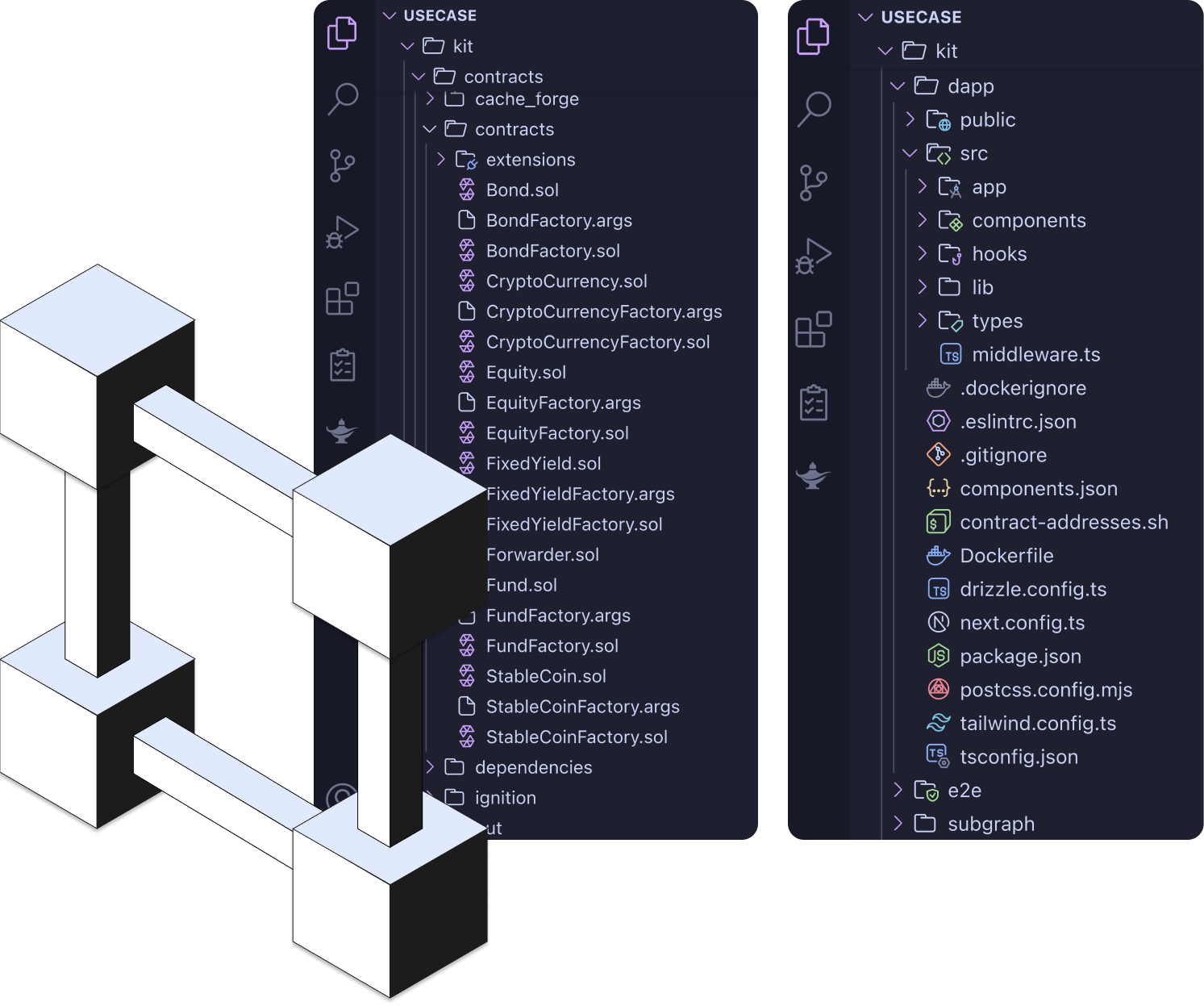

Select from purpose-built templates for bonds, funds, real estate, deposits, stablecoins, and additional asset types. Configure asset parameters — maturity dates, distribution schedules, investor eligibility, jurisdiction rules — with compliance and lifecycle logic built into the template.

② Deploy with compliance built in

Launch on your preferred EVM-compatible network. DALP handles smart contract deployment, OnchainID identity setup, and Key Guardian custody connections. Every token includes ERC-3643/T-REX compliance by default. Deploy to cloud, on-premise, or hybrid infrastructure based on your data residency requirements.

③ Onboard and issue

Connect to your existing KYC/AML providers — DALP enforces their identity claims on-chain through OnchainID and the Identity Registry. Tokens are issued only to verified, eligible holders. Transfer restrictions are enforced at the smart contract level through ex-ante compliance.

④ Settle and service

Execute trades with atomic DvP/XvP settlement — both legs complete or revert together. Automate ongoing lifecycle operations: coupon payments, distributions, redemptions, maturity handling, corporate actions, and cap table management. Immutable audit trails record every event.

⑤ Monitor, report, and scale

Grafana dashboards and the VictoriaMetrics/Loki/Tempo observability stack provide production-grade monitoring. Generate regulatory reports and investor statements. Scale to additional asset types, jurisdictions, and chains — all from the same platform.

FAQs

No. DALP is infrastructure software.

It integrates with your chosen custody providers (via Key Guardian and BYOC), connects to exchanges for secondary market access, and enforces identity claims issued by your KYC/AML providers. DALP does not hold assets, operate a trading venue, or perform identity verification directly.

Every transfer, issuance, or redemption is validated against applicable compliance rules before the transaction executes on-chain.

If an investor is not eligible, or a transfer would violate a jurisdiction rule or holding period, the transaction does not proceed.

This is fundamentally different from ex-post monitoring that flags violations after they occur.

DALP supports multi-chain EVM-compatible networks, including public and permissioned chains.

Multi-chain deployments allow operating across different network environments from a single platform.

Yes. REST, GraphQL, webhooks, and oRPC APIs connect to core banking, payment rails, custody providers, KYC/AML services, and reporting platforms. Key Guardian's BYOC model means existing custody relationships stay intact.

ISO 20022 integration-readiness supports financial messaging interoperability.

DALP's Servicing pillar automates coupon payments, yield distribution, dividends, redemptions, maturity handling, and corporate actions.

Real-time cap tables track ownership. Immutable audit trails record every lifecycle event for regulatory reporting.

7 out of the box: bonds, equity, funds, stablecoins, deposits, real estate, and precious metals — each with purpose-built lifecycle logic.

A configurable token template supports additional asset types. All templates include compliance controls, lifecycle management, and settlement capabilities.

You do. DALP deployments include full source code access.

Deploy on your infrastructure, in your cloud account, with your keys. No vendor lock-in.