Managing the CBDC infrastructure for India's largest bank

Impact Overview

- The roll out of wholesale CBDC is expected in next six months.

- Retail and programmable CBDC infrastructure is being developed

- With 1 billion plus digital transactions per day, the ecosystem is ready for moving from Web2 to Web3 wallets

Challenges

Changes in Consumer Behaviour

Reliance on cash leads to inefficiencies and security risks: Cash transactions are slow, error-prone, costly, and pose risks like theft and counterfeiting.

Meeting Consumer Needs

Limited financial inclusion for underserved populations: Many people lack access to banking services, hindering economic participation and secure savings.

Procedural Optimizations

High costs and delays in cross-border transactions: Traditional international money transfers are expensive and slow due to multiple intermediaries and regulatory complexities.

Solutions

- CBDCs will provide a fast, error-free, and cost-effective alternative to cash, also reducing theft and counterfeiting risks. The infrastructure developed will be resilient on multiple levels, highly secure and scalable.

- Hyperledger Fabric based CBDC solution will offer accessible banking services to underserved populations, also enabling full economic participation and secure saving.

- CBDCs will reduce costs and delays in international transfers by also minimizing intermediaries and simplifying regulatory processes.

Discover the technology behind the stories

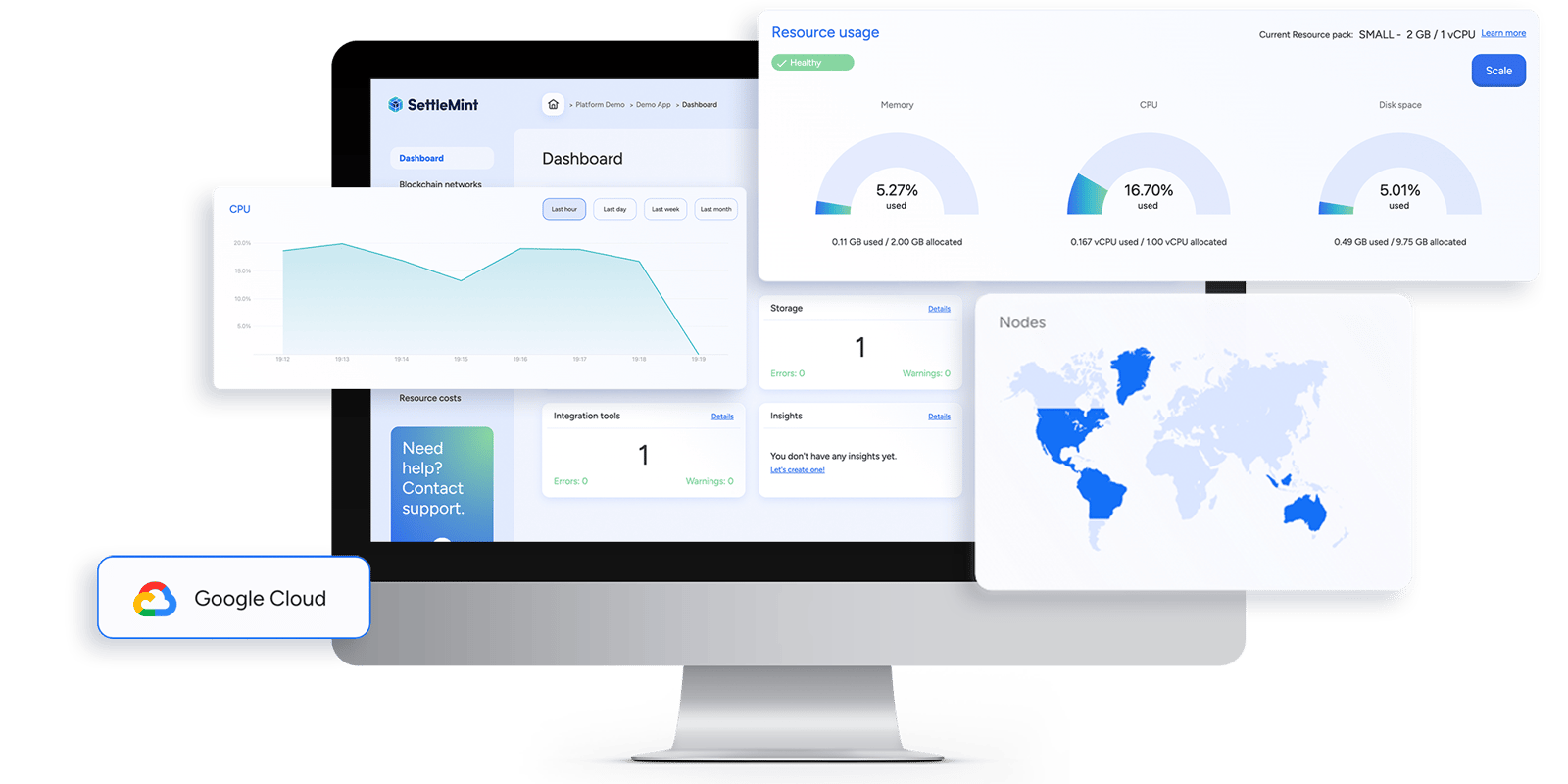

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.