An overview of capital markets

Capital markets are where savings and investments are channeled between those who have excess capital and those who are in need of capital.

Buyers and sellers trade financial securities, such as shares, bonds and other investments, while a range of intermediaries and other institutions, including brokers, agents, clearing houses, custodians, central banks and regulators, play their part in a properly functioning system.

Opportunities for Blockchain Technology in Capital Markets

Tracking assets in capital markets

A key foundation of every capital market is the storage and maintenance of datasets relating to asset ownership and financial obligations.

The market infrastructure for all this activity, which involves trillions of dollars of securities and obligations being exchanged every day, has become highly complex. In addition, it suffers from a lack of common standards, and utilizes fragmented IT solutions and data architectures.

This increases risks for financial institutions, who must continually engage in costly data and process duplication and reconciliation. This then results in increased systemic risk, a higher cost of capital than is necessary, and the exclusion of some participants who can’t afford to take part.

Understanding blockchain technology

Blockchains, like Distributed Ledger Technologies more generally, are decentralized and immutable databases that are shared and updated members of a network via a consensus mechanism that offers zero fault tolerance security.

Data is stored redundantly among nodes, which collectively help to secure the network and to track digital assets, such as cryptocurrencies. In this way, participants agree that their activities are governed by computer code, including smart contracts that execute automatically when certain conditions are met.

How blockchain can improve capital markets

Through the creation of a shared platform for collaboration and the use of smart contracts, blockchain provides an answer to the problems of sharing business and operational data efficiently, and alleviating the need for constant reconciliation.

In the context of capital markets, DLT solutions like blockchain can include some important dynamics, such as:

- Asset ownership records

- Trust between transacting parties

- How transactions are executed

Improvements in these areas can lead to the following benefits for capital markets participants:

- Reduced counterparty risk

- Reduced systemic risk

- Lower operational costs

- Improved liquidity

- Less rent seeking

- Improved Balance Sheet Management

You can find out more about how blockchain can improve capital markets by watching the other videos in our series or by viewing some use cases for blockchain in capital markets, via the links below.

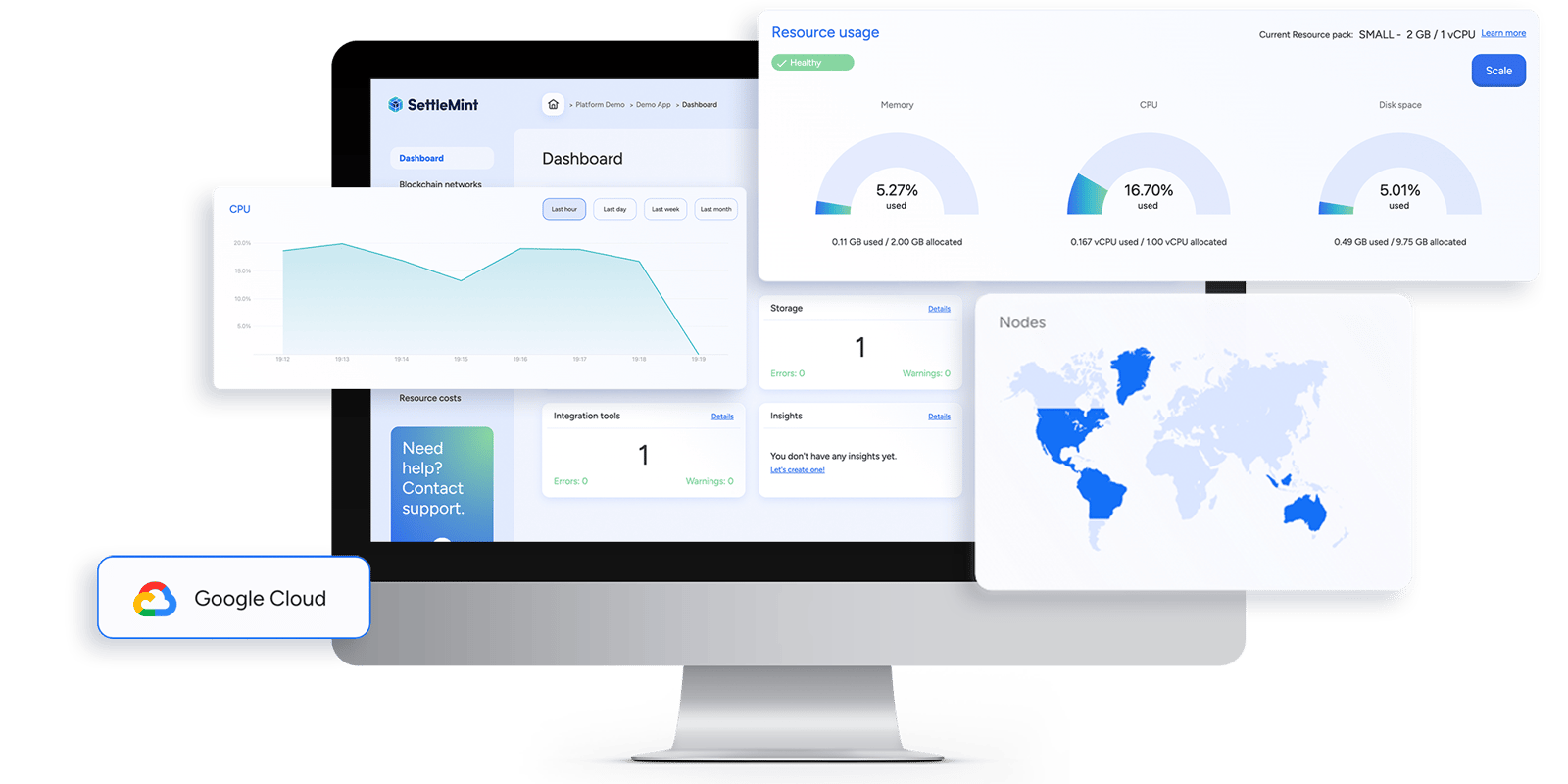

Discover the technology behind the stories

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.

Read more blockchain innovation stories

Demo: How to tokenize assets with SettleMint